Como o Simpli.fi aumentou o ROI em 7x em 3 meses usando o Employee Advocacy do Sprout Social

Ler mais

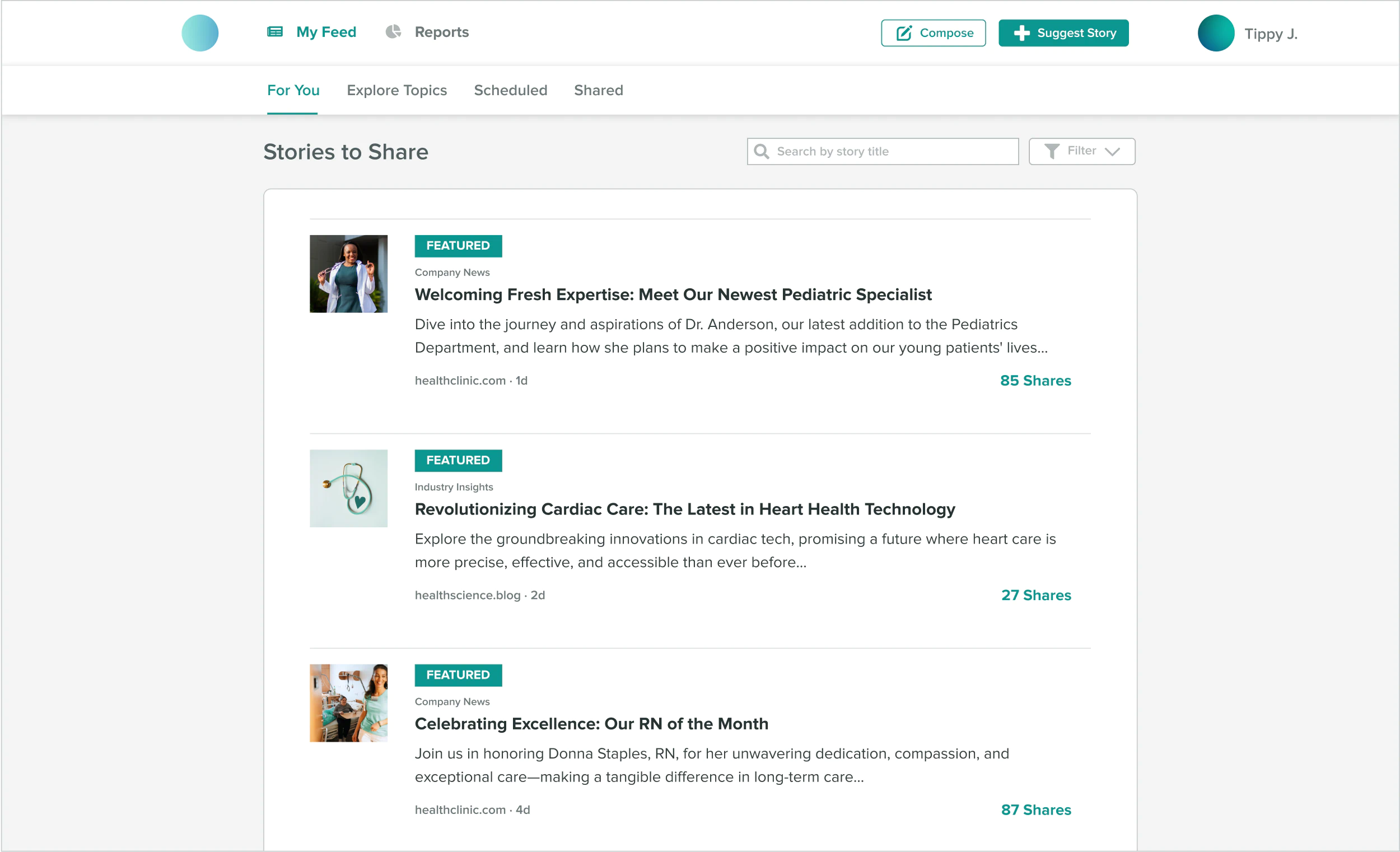

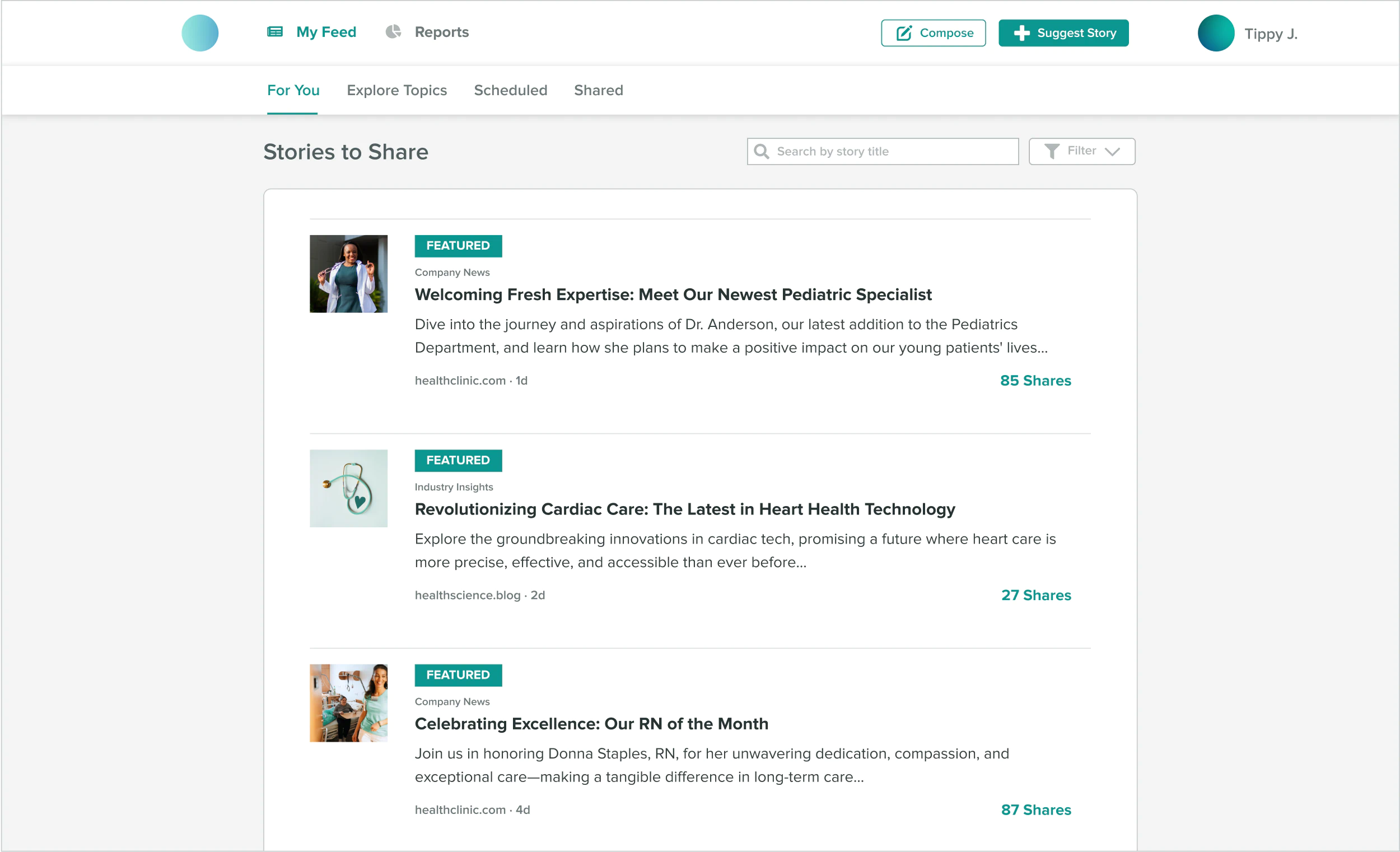

Com o Employee Advocacy, os funcionários podem compartilhar conteúdo da marca em poucos cliques sem desviar do material pré-aprovado. Você poderá validar facilmente o impacto desses funcionários com dados claros para transmitir a história.

Agendar uma demonstraçãoPrepare os funcionários para compartilharem conteúdo de forma rápida e fácil e, depois, meça o quanto você economizou com anúncios com o valor de mídia ganho.

Equipe seus funcionários com conteúdo preparado para gerar oportunidades, para envolver possíveis clientes e atrair talentos, sem aumentar o número de funcionários ou o orçamento dos anúncios.

Conquiste a confiança do seu público garantindo que seus funcionários compartilhem mensagens aprovadas e coerentes com convicção.

US$ 233 mil

Os clientes do Employee Advocacy melhoraram o alcance orgânico em 85% nas redes sociais, economizando US$ 233 mil em gastos com mídias pagas nos últimos três anos.

90%

90% dos executivos de marketing concordam que as redes sociais passarão a ser o principal canal de interação com os possíveis clientes e os atuais.

Como a ferramenta de Advocacia dos Funcionários pode ajudar a sua empresa?

Calcule o seu ROI

Como o Simpli.fi aumentou o ROI em 7x em 3 meses usando o Employee Advocacy do Sprout Social

Ler mais

Medallia estimula o advocacy de funcionários e consegue crescimento exponencial com o Sprout

Ler mais

Marca de empregador para retenção e recrutamento

Ler mais